time:2024-03-15 source:动力电池网

On March 11th, the China Automotive Power Battery Industry Innovation Alliance released monthly data on power batteries for February 2024. In terms of production, in February, the total production of power and other batteries in China was 43.6GWh, a decrease of 33.1% month on month and 3.6% year-on-year.

From January to February, the cumulative production of power and other batteries in China was 108.8 GWh, a year-on-year increase of 29.5%.

In terms of sales, in February, the total sales of power and other batteries in China were 37.4GWh, a decrease of 34.6% month on month and 10.1% year-on-year. Among them, the sales volume of power batteries was 33.5GWh, accounting for 89.8%, a month on month decrease of 33.4%, and a year-on-year decrease of 7.6%; The sales volume of other batteries was 3.8GWh, accounting for 10.2%, a decrease of 43.2% month on month and 27.0% year-on-year.

From January to February, the cumulative sales of power and other batteries in China reached 94.5 GWh, a year-on-year increase of 26.4%. Among them, the cumulative sales of power batteries were 83.9GWh, accounting for 88.8%, with a cumulative year-on-year increase of 31.3%; The cumulative sales of other batteries were 10.6GWh, accounting for 11.2%, a year-on-year decrease of 2.3%.

In terms of loading volume, in February, the loading volume of power batteries in China was 18.0 GWh, a year-on-year decrease of 18.1% and a month on month decrease of 44.4%. The installed capacity of ternary batteries was 6.9 GWh, accounting for 38.7% of the total installed capacity, a year-on-year increase of 3.3%, and a month on month decrease of 44.9%; The installed capacity of lithium iron phosphate batteries is 11.0 GWh, accounting for 61.3% of the total installed capacity, a year-on-year decrease of 27.5% and a month on month decrease of 44.1%.

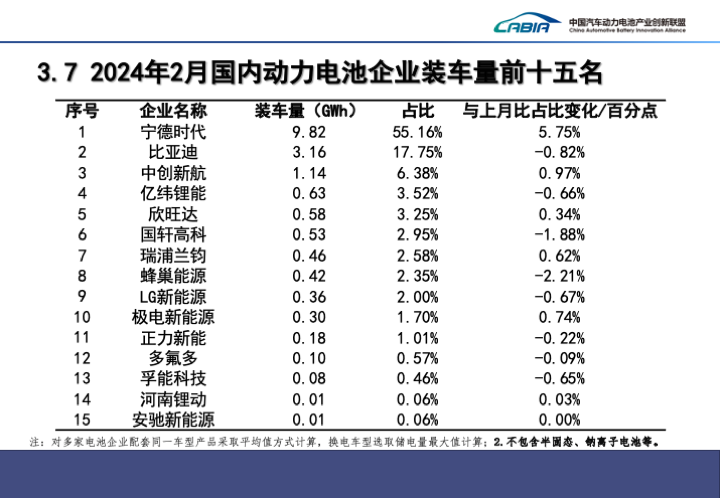

In February, a total of 36 power battery companies in China's new energy vehicle market achieved vehicle installation support, a decrease of 3 compared to the same period last year. The top 3, top 5, and top 10 power battery companies have installed 14.1GWh, 15.3GWh, and 17.4GWh of power batteries, accounting for 78.6%, 85.3%, and 96.7% of the total installed vehicles, respectively. The proportion of the top 10 companies decreased by 1.7 percentage points compared to the same period last year.

Data shows that in February this year, the domestic power battery installation volume of Ningde Times reached 9.82 GWh, with a market share of 55.16%, firmly ranking first. If calculated based on each new energy vehicle carrying 50 KWh of electricity (50 kWh), the above power batteries can be matched with over 196000 new energy vehicles.

BYD's market share fell to 17.75% in February. Although still ranked second on the list, its gap with CATL has exceeded 37 percentage points.

China Innovation Aviation still ranks third on the domestic power battery installation volume list in February. Its market share has increased to 6.38%, which is lower than last year's market share of over 8%.

Yiwei Lithium Energy and Xinwangda have risen to fourth and fifth place respectively, but their market share has not exceeded 4%. In January this year, Yiwei Lithium Energy and Xinwangda ranked sixth and seventh respectively. Guoxuan High Tech, ranked fourth in January this year, slipped to sixth on the list in February, with a market share of less than 3%.

Ruipu Lanjun, Honeycomb Energy, LG New Energy, and Jidian New Energy rank seventh to tenth respectively, with market share exceeding 1%. Jidian New Energy, which is affiliated with Zhejiang Geely Holding Group, has been listed in the top ten for the first time this year.

Zhengli New Energy, Duofuduo, Funeng Technology, Henan Lithium Power, and Anchi New Energy ranked 11th to 15th respectively.

From January to February, a total of 41 power battery companies in China's new energy vehicle market achieved vehicle installation support, an increase of 2 compared to last year. The top 3, top 5, and top 10 power battery companies have installed 37.8 GWh, 41.9 GWh, and 48.2 GWh of power batteries, accounting for 75.2%, 83.3%, and 95.9% of the total installed vehicles, respectively.

In terms of the installation volume of solid-state batteries and sodium ion batteries, from January to February, China achieved the installation of semi-solid batteries and sodium ion batteries. The supporting battery companies are Weilan New Energy and Ningde Times.

In February, the installed capacity of sodium ion batteries was 253.17kWh, and the installed capacity of semi-solid batteries was 166.6MWh; From January to February, sodium ion batteries were loaded with 703.3kWh and semi-solid batteries were loaded with 458.2MWh.

In terms of exports, in February, China's total exports of power and other batteries were 8.2GWh, a decrease of 1.6% month on month and 18.0% year-on-year, accounting for 22.0% of the month's sales. Among them, the export of power batteries was 8.1GWh, accounting for 98.6%, a decrease of 0.7% month on month and a year-on-year decrease of 10.9%. The export of other batteries was 0.1GWh, accounting for 1.4%, a decrease of 38.2% month on month and 87.2% year-on-year.

From January to February, the cumulative export of power and other batteries in China reached 16.6 GWh, accounting for 17.6% of the cumulative sales in the first two months and a year-on-year decrease of 13.8%. Among them, the cumulative export of power batteries was 16.3GWh, accounting for 98.1%, a year-on-year decrease of 1.9%; The cumulative export of other batteries was 0.3GWh, accounting for 1.9%, a year-on-year decrease of 88.2%.